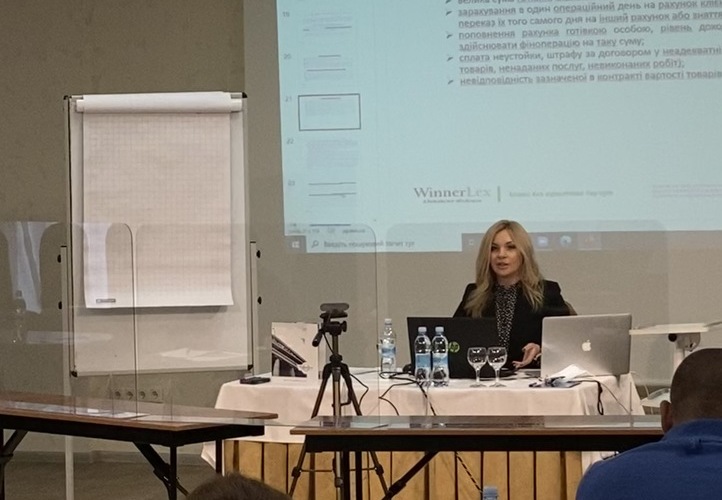

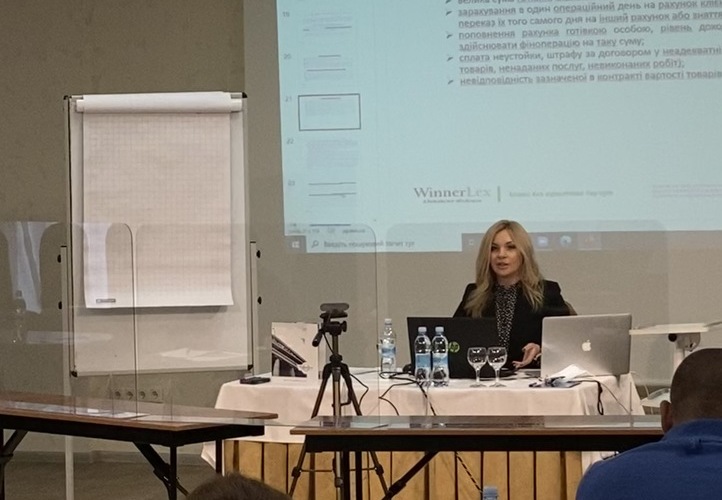

Anna Vynnychenko conducted a seminar on the topic “Tax Minimization, Optimization, and Planning for 2020/2021 Using Legal Methods”

05.11.2020

Managing Partner of WinnerLex Law Firm, Anna Vynnychenko, conducted a seminar on the topic “Tax Minimization, Optimization, and Planning for 2020/2021 Using Legal Methods,” which was organized for professional accountants and business executives by the Business Club.

Anna Vynnychenko is a regular speaker at professional platforms aimed at improving the skills of tax lawyers and financial specialists, given her practical experience working in tax authorities and her daily involvement in business issues in relation to controlling bodies as the managing partner of the law firm.

During her speech, many practical and relevant issues of taxation, financial monitoring, and State Labor Service inspections were covered, including the following:

- The most common tax evasion schemes from the tax authorities’ perspective as risk factors for businesses

- Risks of financial assistance for single tax payers and counteracting illegal annulment of a single tax payer certificate

- Applying the concept of a reasonable economic cause (business purpose) to transactions involving non-repayable financial assistance for corporate tax purposes with both residents and non-residents

- Tax innovations of 2021: Liability of tax authorities’ officials and powers to determine taxpayers’ guilt in audit reports

- Tasks, duties, and rights of entities conducting primary financial monitoring

- Fines for violations of financial monitoring requirements: amounts and subjects, including lawyers, accountants, auditors, and tax consultants as special subjects

- Signs of threshold and suspicious financial transactions for reporting to the State Financial Monitoring Service

- New concept of ultimate beneficial ownership

- Issues related to proving the reality of business transactions to prevent blocking of tax invoices, recognition of a business as risky, and/or establishing fictitious/non-existent transactions in audit reports

- Proving the illegality of assigning the status of a risky taxpayer both pre-trial and in court

- An approximate list of documents required to confirm business transactions for supply and contracting

- What constitutes due tax diligence and what the court focuses on

- The most common questions for questioning by tax inspectors of executives and founders involved in tax evasion schemes

- The “famous” 36 questions asked by investigators during a criminal tax case interrogation: developing correct answers

- Goods (services) received for free from an unknown source as a known argument used by tax authorities

- Justifying economic reasons or business purposes (considering the risks of business activity) for entering into agreements at prices lower than the production cost

- Presence or absence of certain documents, as well as flaws in their preparation, as a possible ground for concluding that business transactions did not occur and denying the formation of a tax credit

- Procedures for forming the schedule of documentary scheduled audits of taxpayers and the legality of making changes

- Criteria for selecting legal entities with high tax risk

- Moratorium on business audits during quarantine

- How to legally prevent an audit and avoid asset seizure

- Consequences of not allowing a tax audit

- Proper analysis of request grounds: when it is legally correct and without consequences for management to avoid an audit

- How to legally refuse to provide information and documents, and when it is inappropriate to do so

- Seven principles for a successful audit

- Differences between proper and improper contesting of audit results

- Circumstances that exempt from financial liability for tax violations and violations of other laws

- Interrogation protocol (explanation) of the director/founder of a counterparty, tax authorities’ reference to court verdicts/criminal case materials as a negative aspect of contesting the tax decision

- Comprehensive audits and procedures for refusing them

- Risks of mass inspection measures to detect unregistered workers during quarantine

- Criteria for risk assessment of State Labor Service audits (grounds for inspection visits and organization of non-visit inspections)

- Signs of labor relations and issues with reclassifying civil law contracts into labor contracts

- Criminal liability for violations of labor law

- Grounds for denying access to a State Labor Service inspection

- Procedure for contesting State Labor Service orders

The seminar not only addressed problematic aspects of the interaction between tax authorities and businesses but also provided specific practical recommendations, especially in light of the upcoming tax innovations for 2021.

Anna Vynnychenko’s next speech will take place on November 13, 2020, on the topic “Tax Disputes 2020. Audits. Tax Control. From Audits to Contesting the Tax Authority Decisions. New Approaches of the Supreme Court. Trends of 2020.”