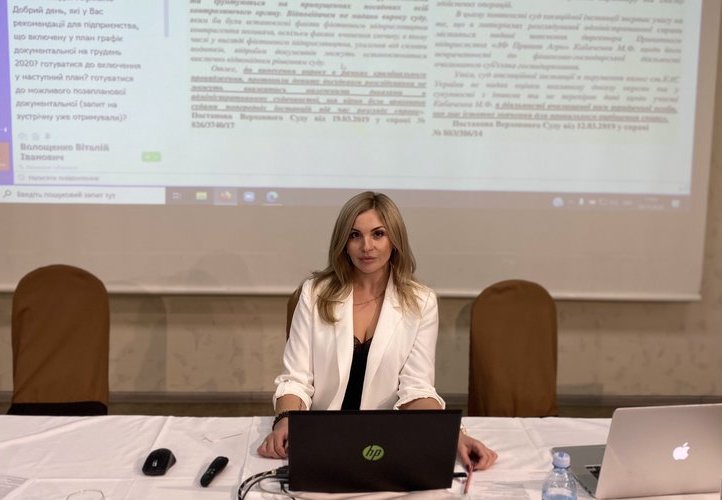

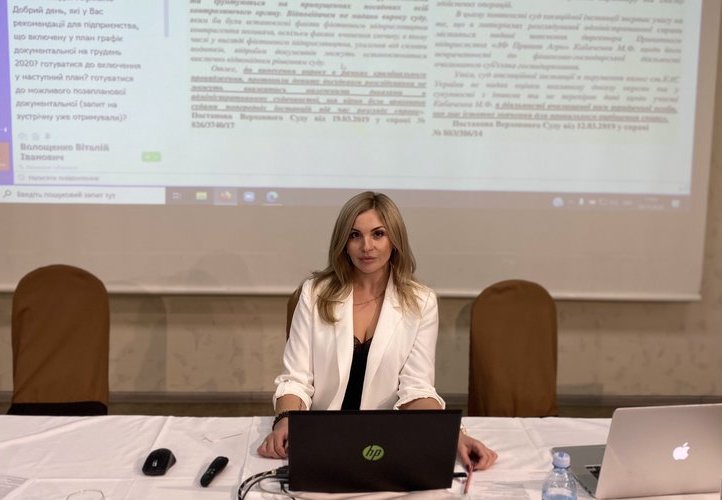

Anna Vynnychenko conducted a seminar for executives, accountants, and financial directors on the topic “Business Risks within the Framework of Changes to Tax Legislation”

17.11.2020

On November 13, 2020, managing partner of WinnerLex law firm, Anna Vynnychenko, conducted a seminar for executives, accountants, and financial directors on the topic “Business Risks within the Framework of Changes to Tax Legislation,” organized by the Business Club.

The slogan of our law firm is “Business without Legal Barriers,” as we see our mission in providing businesses with maximum legal support.

We provide legal support to businesses not only during legal servicing but also through the organization of professional practical seminars for businesses to minimize potential risks arising from legislative innovations and changes in case law.

The relevance of the 2021 tax innovations and the latest trends in the Supreme Court’s legal positions on tax matters necessitates the consideration of potential risks and “pitfalls” for businesses. The following key issues were addressed during the seminar:

1. Business Risks within the Framework of Changes to Tax Legislation:

- How to avoid mistakes that lead to penalties, reassessments, and criminal liability?

- Blocking of tax invoices.

- Challenging the refusal of tax invoice registration. Primary documents. Mutual reconciliation.

- New positions of the Supreme Court. Case law on specific categories of cases.

2. Preparation for a Tax Inspection:

- “Risk Factors”: Grounds for conducting a tax inspection.

- Methods to prevent/avoid a tax inspection.

- Rules for quality preparation for a tax inspection.

- Primary documentation audit.

- Thorough verification of business partners.

- Comprehensive protection of documentation and trade secrets. Staff briefing.

- Identifying authorized persons to communicate with tax inspectors.

3. Access/Non-Access of the Tax Authority for an Inspection:

- Conditions for allowing tax inspectors to conduct an inspection.

- List of documents to be presented by inspectors before the inspection begins.

- Deficiencies and discrepancies in these documents to watch for.

- Legal grounds for not allowing tax inspectors to conduct an inspection.

- Justification for the legality of non-access for inspection.

- Procedures for documenting non-access.

- Administrative seizure of taxpayer assets in case of non-access to the inspection.

- Judicial appeal against the seizure of taxpayer assets.

- Procedure for imposing seizure of funds from taxpayer accounts: Supreme Court’s position.

4. Tax Inspection Procedures:

- Participation in the inspection process. Conditions for exercising taxpayer rights.

- Methods for monitoring compliance with the inspection procedure and responding to illegal actions by tax inspectors.

- Photo and video recording during the inspection.

- Original documents.

- Procedure for providing documents to tax inspectors for review.

5. Filing Objections Against Inspection Reports:

- Requirements for the format and content of inspection reports. Mandatory requisites of the inspection report.

- Procedures for signing the inspection report.

- Taxpayer’s actions in case of disagreement with the inspection report findings.

- Timeframe for submitting objections against the inspection report.

- Legal status of the inspection report and its relationship to the tax notice-decision.

6. Appealing the Results of the Tax Inspection:

- Ways to appeal the results of a tax inspection.

- Business Ombudsman: possibility of involving in the review of a taxpayer’s complaint.

- Administrative appeal.

- Judicial appeal.

7. Criminal Proceedings in Tax Disputes:

- Protection of taxpayer interests in the event of criminal proceedings.

- Decriminalization of fictitious entrepreneurship (Article 205 of the Criminal Code). Its significance and consequences for business.

- The court’s verdict as grounds for determining the invalidity of business transactions between the taxpayer and their counterparties.

- The relationship between fictitious counterparties and tax benefits: the Supreme Court’s position.

Anna Vynnychenko and the professional team of WinnerLex law firm provide daily legal support to business structures in their interactions and issues with regulatory authorities (tax and customs authorities, Antimonopoly Committee, State Labor Service, State Land Agency) and continuously monitor legislative changes, especially in light of the latest wave of reforms and legal innovations.