Tax attorneys of WINNERLEX Law Firm successfully unblocked tax invoices for a “risky” client worth over 3 million UAH through legal proceedings

19.02.2022

In October of this year, we already published an article on our website dedicated to the practical aspects of unblocking tax invoices for businesses that were classified as “risky” under Clause 8 of the Criteria for Riskiness of a VAT Payer (Order No. 1165).

As an example, we cited a case in which the tax attorneys of WINNERLEX Law Firm successfully proved in court that the tax authorities had no legal grounds to block our client’s tax invoices, despite the client being deemed “risky” under Clause 8 of the Criteria.

And once again, we have demonstrated that the “risky” status is not an obstacle to unblocking tax invoices through legal proceedings.

It is not uncommon for tax authorities to set certain conditions for removing the “risky” status, such as significantly increasing tax liabilities, making adjustments regarding specific counterparties, or paying additional VAT. If such conditions are unacceptable for a business, the only way to restore the buyer’s VAT credit and avoid penalties from the buyer is to file a lawsuit for the unblocking of tax invoices.

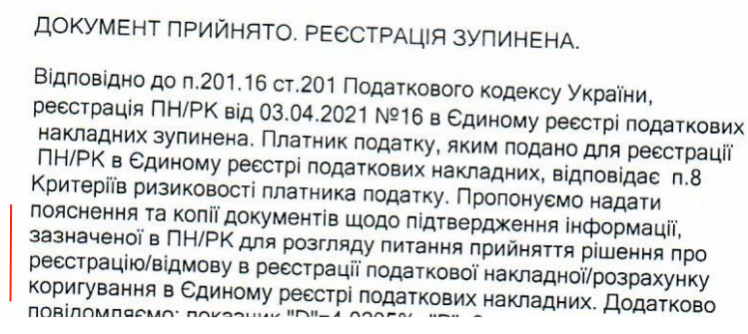

Thus, in the electronic taxpayer cabinet, our client received standard Tax Invoice/Adjustment Calculation Registration Receipts, stating the following:

So, once again, we see a typical demand from the tax authorities —”bring something, but we won’t tell you what exactly.” It is completely unclear from the Receipts what specific documents need to be submitted along with explanations for the blocked tax invoices. This lack of clarity then allows the tax authorities to claim that something was missing and use it as a reason to deny the registration of tax invoices.

After the tax invoices were blocked, the client submitted explanations along with copies of documents confirming the business transactions, including: contracts, payment invoices, purchase orders, delivery notes, service acceptance acts, and bank statements.

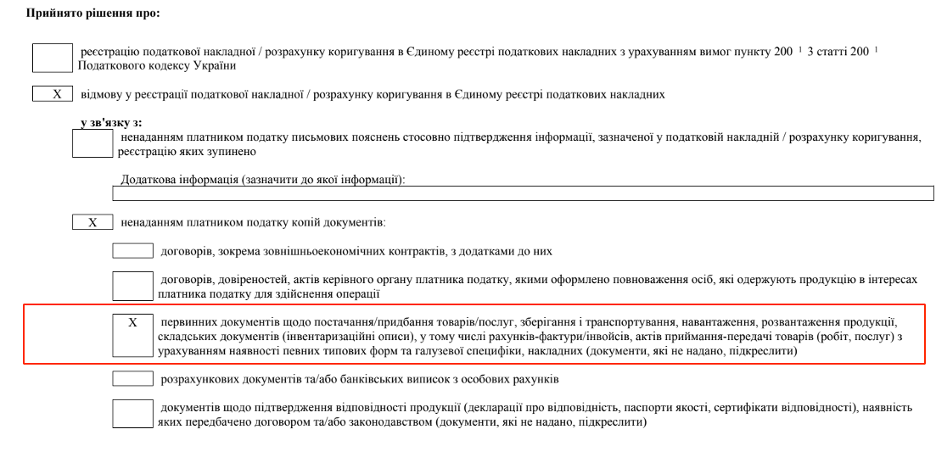

However, after reviewing the explanations, the client received a Decision on the Denial of Tax Invoice/Adjustment Calculation Registration from the tax authorities, with the same vague wording:

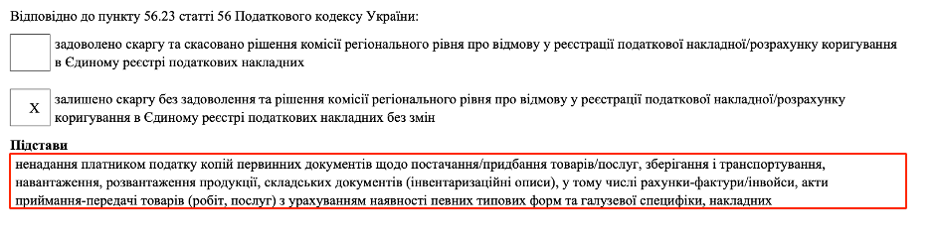

The complaints filed against these decisions were also not satisfied. The refusals to grant the complaints were justified using a rather commonly used wording:

And once again, it remains unclear which specific documents were supposedly missing. What’s more — all the required documents had already been submitted by the client at the explanation stage for unblocking the tax invoices.

To unblock the tax invoices and ensure their subsequent registration, the tax attorneys of WINNERLEX Law Firm filed an administrative lawsuit with the Kyiv District Administrative Court.

The primary focus of the lawsuit was on providing a detailed description of the business transactions. For each contract under which the transactions were carried out, the terms of goods delivery, the method of transportation, and the payment procedure and deadlines were specified and analyzed. This approach helped confirm the list of primary documentation that should have accompanied the transactions for which the tax invoices were issued and later blocked.

Additionally, in this particular case, the transactions involved the transportation of goods both within Ukraine and from Poland to Ukraine. Therefore, the lawsuit also included a detailed analysis of the transport forwarding contracts signed with other counterparties, as well as the specific circumstances of their execution.

Furthermore, given that some of the business transactions involved a non-resident counterparty, WINNERLEX tax dispute attorneys emphasized in the lawsuit that customs declarations were submitted, and customs duties were duly paid when crossing the border. A proper legal assessment was provided, highlighting the key circumstances confirming the genuineness of these transactions in light of similar successful cases of our clients.

As a result, the Kyiv District Administrative Court considered all the arguments presented by WINNERLEX tax attorneys and, by its ruling, fully satisfied the lawsuit for unblocking the tax invoices.

Upon granting the lawsuit, the court motivated its decision as follows:

“The court notes that the receipt sent to the plaintiff regarding the suspension of the tax invoice registration did not provide an exhaustive list of documents required to make a decision on the registration of the tax invoice in the Unified Register of Tax Invoices (URTI).

According to Clause 11 of Order No. 520, the regional commission makes a decision to refuse the registration of a tax invoice in the URTI if: the taxpayer fails to provide written explanations regarding the information specified in the tax invoice/adjustment calculation whose registration has been suspended in the Register; and/or the taxpayer fails to provide copies of documents in accordance with Clause 5 of this Order; and/or the taxpayer provides copies of documents that are drawn up/issued in violation of the legislation.

Therefore, in this case, the court states that the tax authority’s use of a general clause regarding different types of risk assessment criteria is vague and leads to the unjustified restriction of the taxpayer’s right to be informed about the modeling of behavior and being not notified about the need to provide documents in an exhaustive and clear list.

Failure by the tax authority to comply with legislatively established requirements concerning the content, form, justification, and reasoning of individual actions results in the act being recognized as unlawful.

The court concludes that the defendant unlawfully suspended the registration of the plaintiff’s tax invoice and unlawfully issued the disputed decision to refuse the registration of the said tax invoice in the URTI, as the tax authority only made a general assessment of the documents provided by the plaintiff. The collection of primary documents submitted to the case materials gives no grounds for doubts regarding the conduct of business between the plaintiff and its counterparty, based on whose requirements the disputed tax invoices were issued.

A similar legal position was stated by the Supreme Court in its ruling dated January 30, 2020, in case No. 300/148/19.”

In this case, it is quite clear how much advantage a qualified tax attorney brings to resolving such disputes. In practice, to unblock a tax invoice, on the one hand, it is necessary to explain the content and essence of the business transactions in a specific legal way to prove the completeness of the list of documents submitted for the unblocking of the tax invoice. On the other hand, it is necessary to prove the unlawfulness of the vague requirements by the tax authorities for the provision of documents to unblock the tax invoices.

The positive result of the court’s consideration of this case clearly demonstrates the high professional level and effectiveness of WINNERLEX tax attorneys, under the leadership of Managing Partner Anna Vinnychenko, who once again proved their expertise in defending the client’s interests. As a result, tax invoices totaling over 3 million UAH were unblocked.